Older Americans Prepped for Economic Curveballs

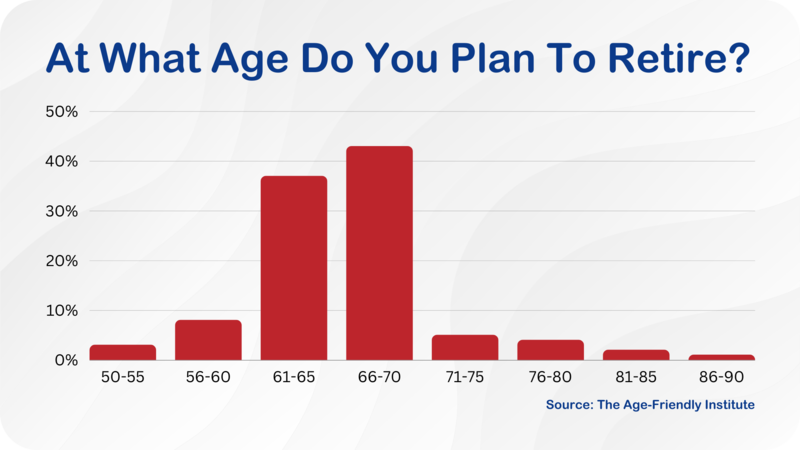

Economic uncertainty has older adults nearing retirement decision time seeking the safer path: working full time a little longer and committing to part-time work in retirement. While age 64 recently has been the average for full-time retirement, a new national survey of older adults reveals most people say they’ll be ready to retire somewhere between 66 and 70.

Economic uncertainty has older adults nearing retirement decision time seeking the safer path: working full time a little longer and committing to part-time work in retirement. While age 64 recently has been the average for full-time retirement, a new national survey of older adults reveals most people say they’ll be ready to retire somewhere between 66 and 70. 1 in 4 say recent changes in the economy have prompted them to push out their full retirement date. Nearly 50% of adults age 50+ say retirement for them is going to be defined as working part-time.

There are multiple factors involved and it’s a personal decision, but economic security in later life often revolves around the themes of working longer, saving more and wanting less.

Preparing for Curve Balls

Older adults have grown more accustomed to uncertainty. This, due to a very recent pandemic, a relatively recent great recession, a generally volatile economy, inexorable decline of pensions, and the omnipresent possibility of health adversity. If someone has a chronic or debilitating health issue, for example, they may not be able to work as long as they like. Shawn Greene, a member of AgeFriendly.org, commented “Since Covid, and due to a sudden change in my physical mobility, I am seeking work at home jobs on the internet”.

Control is key. A key factor driving older adults’ plans to work longer: they know this will help them better control the “when” question about retirement, and allay the fears of running out of money. There’s the consideration of moving to a ‘retirement job’. While age can still be an impediment when job hunting, employers are warming to the idea of keeping people longer and developing phased retirement options. Some managers are rehiring retirees. Many organizations have created employee resource groups to help older adult staffers not only feel more welcome but to help them with practical things such as care for aging parents and financial planning. With staffing tight and DE&I more highly valued in the C-Suite, they’ve also joined the fast-growing crop of Certified Age-Friendly Employers.

Saving More

Older adults are well-advised to pay themselves first. The average Social Security monthly retirement benefit is roughly $1,800. If not currently saving, people should start with a modest 2% to 4% and increase it as they simultaneously reduce living expenses. It’s always wise to contribute to the savings plan at work or to an individual IRA. These contributions can largely be made on a pretax basis. And it’s never too late to consult a financial advisor about ways to maintain consistent income streams during retirement. Depending on your situation, certain types of annuities, for example, might make sense. According to an Age-Friendly Institute survey, most began saving for retirement in their 30’s. The median savings for Americans age 65 to 74, per government reports, is $164,000.

Wanting Less

Lacking a substantial savings, older Americans may be unable to retire exactly when they want. That’s why many people will want to adjust their standard of living once they no longer bring home a regular paycheck. Good ideas they can consider: cutting living costs, downsizing, selling the second car, eating out less often and cooking from scratch. While travel is often on an older adult’s agenda, there are many ways to get enjoyment from travel on a shoestring including closer-to-home expeditions by car.

About the Survey

The Age-Friendly Institute surveyed a nationally representative sample of older adults age 50+ in March 2023. There were 284 respondents.

There are no comments for this article yet. Be the first to leave a comment